African countries wishing to enter China’s local bond market through “panda” bonds face major challenges due to their huge debt burdens and lack of market infrastructure, according to what Reuters quoted investors and analysts as saying.

Although African governments have been issuing bonds in foreign currencies, especially in US dollars or euros, for decades, entering the second largest bond market in the world is still difficult to achieve.

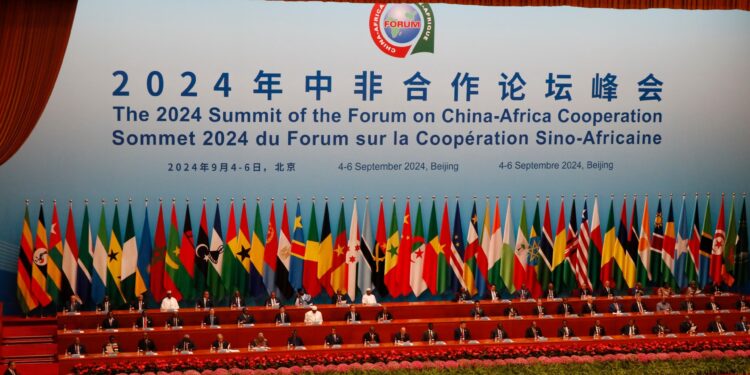

Although Chinese President Xi Jinping recently encouraged during the China-Africa Summit (started on September 4th) to support African countries in issuing “panda” bonds, experts pointed to fundamental obstacles. “The Chinese yuan is not freely traded globally, which makes these bonds less attractive,” Linda Irulo, an assistant professor at Georgetown University in Qatar, told Reuters.

Rapid growth of panda bonds

While the panda bond market is growing rapidly, with issuance reaching $18 billion in the first three quarters of 2023, exceeding $11 billion for the full year in 2022, challenges remain for African issuers.

Although Beijing has eased issuance rules, allowing exporters to spend or transfer proceeds in China, obstacles remain, Reuters reported. For example, liquidity problems and limited trading of the yuan globally are considered a challenge compared to the dollar.

Christopher Lee, a senior analyst at Standard & Poor’s for the Asia-Pacific region, noted that China’s low interest rates are an advantage. “We expect domestic financing costs to remain cheaper even with the reduction in US interest rates,” he said. However, this factor may not be enough to overcome the obstacles faced by African governments.

Between China and America

Jack Buffington, a professor at the University of Denver, explained that African countries interested in expanding manufacturing and supply chains are seeking to find a balance between American and Chinese influence. “Most African countries that have growth potential in manufacturing and supply chains are interested in balancing the influences of the United States and China,” he said.

For example, Kenya is looking to issue $500 million in Panda bonds this fiscal year, and President William Ruto recently asked China to restructure Africa’s debt to give longer grace periods. The move comes after Kenya joined the Asian Infrastructure Investment Bank (AIIB). , which is a prerequisite for issuing Panda bonds.

Liquidity issues and dollar dominance

Although China is considered Africa’s second largest creditor, the US dollar remains dominant in global trade and financial markets, making the shift towards financing in the Chinese currency difficult. Although the share of the dollar as a global reserve currency has declined to 59% from 70% in the past decade, it still far exceeds the yuan, and this means that African countries may face higher costs and liquidity problems when issuing bonds in the Chinese currency.

Otavio Medeiros, Brazilian Deputy Treasury Minister for Public Debt Affairs, expressed skepticism about the shift away from the dollar, saying, “It is better, at least in the short term, to focus on the dollar, which has great liquidity.” At the same time, Hungary’s issuance of panda bonds since 2017 has not resolved liquidity and deal settlement concerns, noted Sergey Dergachev, portfolio manager at Union Investment.

Encouraging signs but caution is required

Despite the challenges, Bangi Vihintola, Executive Director at Africa Finance Corporation (AFC), believes that African countries should continue to explore the issuance of panda bonds, pointing to Egypt’s success in issuing Japanese “Samurai” bonds worth $500 million as evidence of the possibility of benefiting from… From alternative financing markets.

But he warned against relying solely on Western funding sources, saying, “If we always rely on the West to raise capital without looking at alternative funding sources, then this is not the right strategy.”