World Public debt exceeded $ 100 trillion by the end of 2024, according to the International Monetary Fund, which is higher than the total value of the globally registered funds estimated at $ 80 trillion, according to the “World Biolichen Review” platform.

The fund expects the debts to rise to a level equivalent to 100% of the Global GDP by 2030.

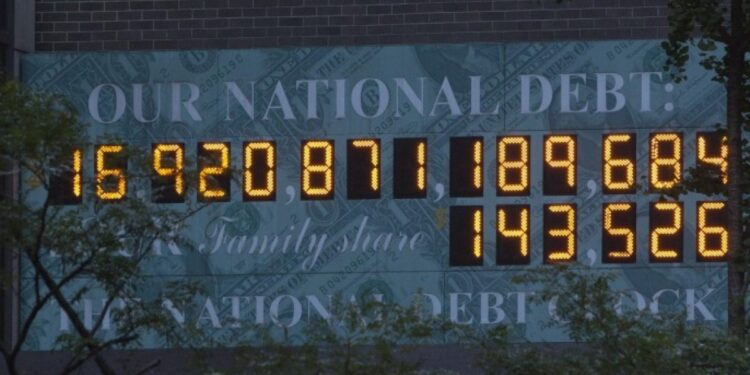

The debts of the United States constitute the largest part of these debts, reaching $ 36 trillion in 2024, equivalent to 34.6% of the global total, based on the data of the US Treasury.

Although former US Treasury Secretary, Janet Yellen, warned in January 2023 of the risks of the continued rise in debts, the US government continued borrowing to the debt to $ 36.2 trillion at the time of writing this report.

Despite the high levels of debt, the United States is still the largest global economy, with the real GDP with 2.8% in 2024 compared to 2.9% in 2023, driven by increased consumer spending, investment, government spending and exports.

In contrast to economic growth in the United States, many third world countries, including major Arab countries such as Egypt, Morocco, Jordan and Tunisia, suffer from debt cycle and high benefits that drain a large percentage of their gross domestic product. Nevertheless, the debts of these countries remain small compared to the debts of the United States.

For example, according to Vigioal Capitalist, based on the data of the International Monetary Fund:

- The debts of Egypt amounted to 340.5 billion dollars in 2024, equivalent to only 0.3% of the world public debt.

- Morocco’s debt reached 107 billion dollars (0.1% of the global debt).

- Jordan’s debt reached 49 billion dollars.

Several questions arise about the global economy: How does America flourish despite its high debts? And why are developing countries to pay the benefits of their debts? Is debts used as a tool for colonial domination of the capabilities of countries, especially in Africa and Asia?

https://www.youtube.com/watch?v=r1jul9m4gqs

How does America flourish despite its high debts?

Despite the differences between the Republican and Democratic parties, they share a remarkable ignorance of the issue of debt and impotence, according to Professor Mark Copenovich of the University of Wisconsin, in an article he posted on the “Intercomstist” platform.

For decades, the idea that federal religion was a national crisis present in American political discussions. In the 1980s, the debt rate to GDP reached 40%, and in the nineties 60%, and in the first decade of the twenty -first century it reached 100%, but now, the percentage reached 120%, and the budget office in Congress expects to reach 166%by a year 2054.

Despite the historically high American debt levels, which exceed the levels of World War II, successive American governments continue to borrow at low interest rates without expectations of excessive inflation or economic crisis.

Kopilovic believes that the idea that the United States is facing an imminent financial crisis such as those suffering from developing countries is wrong. Nevertheless, American debt is not without real costs, such as the future debt and political bodies.

https://www.youtube.com/watch?v=s1y53z-7qvk

The dominance of the decisive dollar to the global economy

Debt is not a source of great concern for the United States due to the dominance of the dollar as a dominant international currency. This is due to the power of the American economy and the deep and liquid financial markets, as well as the international demand for “safe assets” and the US government’s willingness to work as a last resort lender in global crises.

Also, potential alternatives, such as the euro or the yuan, do not pose a real threat to the dollar in the near future, according to Professor Mark Copenovich.

The dominance of the US dollar is able to finance itself with less restrictions compared to any other country. Although high debt levels may constitute a future challenge, considering the American debt “undesirable” is a categorical error as the writer mentions.

For example, the percentage of debt to GDP in Japan is 250%, and it borrows at low interest rates, indicating that the United States, which faces a much lower percentage, does not need excessive anxiety over its debts, according to Kobelovic.

Other reasons for the prosperity of the American economy

In addition to the dominance of the dollar:

- The United States has the largest global economy, with GDP reached 29.17 trillion dollars in 2024, which represents 25.95% of the global economy, according to Statista.

- American -transcontinental companies, especially technology companies, control the list of the largest international companies, as it includes 8 of the 10 largest companies in the world in terms of market value, according to the “Companizations Cap” platform.

- The United States also includes the largest securic market in the world, and its market value is expected to reach 54.88 trillion dollars by 2025, according to Statista platform, which enhances its position as the largest global economic power.

Why are developing countries to pay the benefits of their debts?

Unlike developed countries like the United States, developing countries suffer from debt cycle and high benefits, as the total (private and public) debt for developing economies reached 29 trillion dollars at the end of 2023, equivalent to 206% of its gross domestic product, according to “UNCTAD”. .

Among the most important causes of this crisis:

- High borrowing costs

Developing countries borrow at 2-4 times higher interest rates than the United States and 6-12 times from Germany, making debt payment more difficult and limits their ability to finance investments and development programs. - High interest payments

In 2023, the net interest payments on the public debt of developing countries amounted to 847 billion dollars, an increase of 26% over 2021. 54 developing countries allocated more than 10% of their government revenues to pay interest. - Borrowing in foreign currency (dollar)

Many developing countries resort to borrowing in dollars due to the current account deficit, which increases the burdens of debt due to their obligations to international lenders. - Conflicts and wars

Third world countries face wars and conflicts that lead to structural changes in their economies and increase security spending, which reduces the financial space available for development and increases dependence on borrowing. - Other reasons

Economic management, the spread of corruption, the weak financial policies, and the inefficiency of tax systems.

The most prominent destructive debt effects:

In August 2023, a United Nations report described the global debt crisis as a “developmental catastrophe that is fueled by an overwhelming debt crisis,” noting that half of humanity (3.3 billion people) live in countries that are spent on the interests of debt benefits more than it spends on education or health.

Despite this, this debt is considered not affecting the global financial system of its concentration in poor countries, which the report described as “mirage”, stressing that this crisis constitutes a systematic failure at the global level.

These are the most prominent devastating effects of debt:

- Draining national resources

In 2022 developing countries witnessed negative net flows of 49 billion dollars, as they paid more to their creditors compared to what they received. This depletion of resources impedes development and weighs the people.

- The deterioration of the education and health system

48 developing countries suffer from the spending of their governments on the benefits of debt more than they spend on education and health, which negatively affects the productivity of peoples and investment in infrastructure. This is a great concern that threatens the future of generations.

According to the United Nations report, the current debt crisis reflects the “dynamics of colonial power” included in the old global financial system, which failed to provide a safety network to help countries confront shocks such as epidemics, climate crises, and wars.

While debt can be a tool for development, it turns into a trap that generates more debts when states are forced to borrow only for economic survival.