Wall Street continues to progress before market this Thursday, following the rally the day before marked by a new historic high for the Dow Jones. The markets yesterday welcomed the announcements from the Fed, which is counting on three rate cuts next year, and the much more flexible comments from Jerome Powell. The S&P 500 gained 0.3% in pre-session, the Dow Jones 0.2% and the Nasdaq 0.4%. Operators are now estimating the rate peak reached, while inflation seems to be under control according to the latest consumer price and inflation figures, and a soft economic landing also seems possible across the Atlantic. …

Unemployment claims fell significantly last week in the United States. The US Department of Labor reported unemployment claims for the week ending December 9 at just 202,000, down 19,000 from the previous week. The consensus was positioned at 220,000. The four-week average stands at 213,250, down 7,750. Finally, the number of unemployed people receiving compensation for the week ending December 2 stood at 1.876 million, up 20,000 over seven days (1.557 million consensus).

Retail sales in the United States for the month of November 2023 clearly exceeded market expectations, growing by 0.3% compared to the previous month against -0.2% of the FactSet consensus. Excluding automobiles, retail sales increased by 0.2% compared to the month of October, against -0.2% consensus. Excluding automobiles and gasoline, finally, sales would have even increased by 0.6% compared to the previous month, against +0.2% consensus.

US import prices for the month of November fell by 0.4% compared to the previous month, against -0.7% consensus and -0.6% for the revised reading of the previous month (-1.4 % over one year). Export prices fell 0.9% month-on-month, compared to -1% consensus.

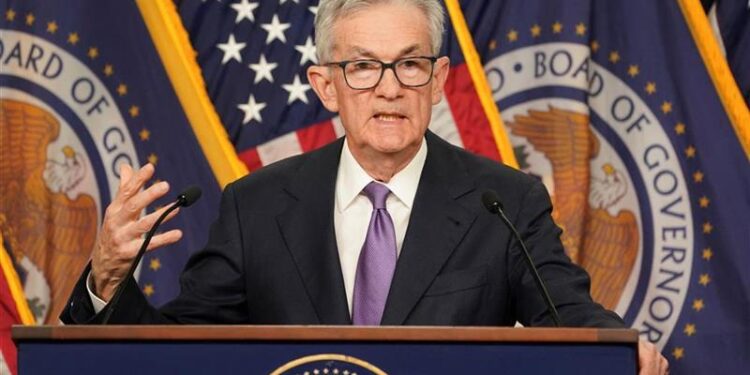

The Fed, as expected, yesterday evening maintained its rates between 5.25% and 5.50% for the third time in a row, while its president Jerome Powell indicated that the key rate was “approaching if not already having reached its peak”. “We believe that our key rate is at its peak, or close to its peak for this tightening cycle, and the economy still surprises forecasters,” insisted the Fed boss during the press conference. following the meeting of the Fed’s monetary policy committee, the FOMC. “We are ready to tighten our policy further if necessary,” nevertheless qualified Powell, who also said that the reduction of the Fed’s balance sheet (quantitative tightening) would continue.

Fed officials “don’t think it will be appropriate to raise rates further,” but they also “don’t want to rule out the possibility”… “The question of when it will be appropriate to cut rates begins to settle down,” Powell added, fueling hopes of an end to the tightening cycle. In its press release, the American central bank indicated that its decision for a new status quo had been taken unanimously. Members of the Fed’s board of governors further emphasized that inflation had declined over the past year. they intend to monitor activity to see if further rate increases would be necessary, implying that after months of monetary tightening, it may no longer be necessary to increase rates… 17 of the 19 officials The Fed forecast the policy rate will be below its current level at the end of 2024, with the median projection showing the rate falling three-quarters of a percentage point from the current target of 5.25% to 5.50%. No official expects rates to rise by the end of next year.

In its economic forecasts, the Fed anticipates inflation at 2.8% for the end of 2023 and 2.4% for the end of 2024. The unemployment rate in the United States would increase from 3.7% currently to 4.1%, a projection identical to that of September, while economic growth is expected to slow, falling from 2.6% this year to 1.4% in 2024.

These forecasts support the thesis of a soft landing, the rosy scenario being that inflation continues to slow without leading to recession or a sharp rise in unemployment. “I always thought inflation could go down without causing a recession, and at the moment that’s what we’re seeing,” Powell said.

The CME Group’s FedWatch tool now shows a probability of nearly 17% that the Fed will reduce its rates by a quarter of a point as of January 31, 2024! The probability of a relaxation no later than March 20 reaches almost 84%! The same tool envisages a rate range of 3.5-3.75% (probability of more than 30%) or 3.75-4% (probability of 38%) at the end of next year, which would reflect a rate reduction of at least 1.5 percentage points.

Tomorrow Friday, Four Witches Day (simultaneous expiration of 4 types of contracts: index and stock options, as well as index and stock futures), investors will follow the Empire State manufacturing index of the New York Fed, industrial production figures, as well as the US composite flash PMI index.

In corporate news on Wall Street, Adobe and Nordson Corporation revealed their results last night. Costco Wholesale (after market), Lennar, Jabil and Manchester United announce this Thursday. Darden Restaurants will finally be on the Friday menu.

Values

Adobe weakens before the market on Wall Street. The group beat the profit consensus for the closed quarter, but its outlook disappointed somewhat. For the fourth fiscal quarter just ended, the American software group achieved adjusted earnings per share of $4.27 compared to a consensus of $4.14. Revenues, at $5.05 billion (+12%), also narrowly exceeded consensus. The group thus posted historic revenues of $19.41 billion for the 2023 financial year, while earnings per share increased by 17%.

Adobe, known for its Acrobat, Photoshop, Flash and InDesign products, delivered revenue guidance ranging from $21.3 billion to $21.5 billion for the fiscal year ending at the end of 2024, with adjusted earnings per share for the period expected. between $17.6 and $18. For the first fiscal quarter of 2024 alone, revenues are expected between $5.10 and $5.15 billion, while adjusted EPS is expected between $4.35 and $4.40. The consensus was for $5.19 billion in revenue and $4.26 in adjusted earnings per share for the quarter, and $21.7 billion in annual revenue. Investors therefore fear a slightly slower than expected rise in AI…

Nordson, the American producer of industrial equipment and machinery, announced last night, for its fourth fiscal quarter, revenues of $719 million, an increase of 5% year-on-year, for an operating profit of $185 million and a adjusted earnings per share of $2.46. For the year, revenues totaled $2.6 billion, an increase of 2% compared to last year. Annual Ebitda was also record, at $819 million, representing 31% of sales. Adjusted earnings per share for the year stood at $9.03, compared to a consensus of $8.97. For the 2024 financial year, sales are expected to grow by 4 to 9%, for adjusted EPS to increase by 1 to 8%.

Jabil, the U.S. electronics manufacturing contract manufacturer, reported revenue of $8.4 billion, GAAP operating income of $303 million, adjusted operating income of $499 million and adjusted earnings per share of $2.60. The consensus was for $2.58 in adjusted earnings per share on $8.35 billion in revenue. It is therefore outdated. A year earlier, the group had generated revenues of $9.64 billion and adjusted EPS of $2.31. For its second fiscal quarter 2024, Jabil anticipates revenues ranging from $7 to $7.6 billion, for adjusted EPS ranging from $1.73 to $2.13. Revenues for the year are finally expected at around $31 billion, for adjusted EPS of more than $9 and adjusted free cash flow of more than $1 billion. The market consensus was for $31.6 billion in revenue and $9.04 in adjusted EPS.

Berkshire Hathaway, Warren Buffett’s investment firm, has acquired additional shares of oil producer Occidental Petroleum for nearly $590 million. Berkshire purchased nearly 10.5 million additional Occidental shares during the week, according to filings made with the SEC (Securities & Exchange Commission). These purchases bring Berkshire’s stake to 27% of Occidental’s capital. Buffett’s firm also has preferred securities and warrants allowing it to acquire nearly 84 million additional shares for $4.7 billion.

Moderna ignites before market on Wall Street. It must be said that a personalized vaccine developed by Merck and Moderna helped prevent the recurrence of serious skin cancer for three years, according to promising new results from a study. Patients with severe melanoma who received the vaccine and the anti-cancer drug Keytruda (Merck) would be 49% less likely to die or see their cancer return than those who received Keytruda alone, according to the two partners.

Apple, the world’s largest market capitalization, gained another 1.7% last night on Wall Street. The Californian group from Cupertino is worth nearly $3.1 trillion, accumulating gains of nearly 60% since the start of the year, while investors are banking on a return to growth for the Apple group. “Apple is so big that it almost eclipses the French stock market,” notes Bloomberg, who speaks of a stock market rally showing no sign of weakness. The stock hit an all-time closing high yesterday. “The valuation of the designer of the iPhone is approaching that of the largest stock market in Europe, France,” calculates Bloomberg. “The combined market value of companies listed in Paris amounted to around $3.2 trillion at Wednesday’s close, compared to $3.1 trillion for the technology giant,” notes Bloomberg, referring to an index established by the agency.