Baghdad- At a value of more than $ 3.5 trillion in 2024, Arab trade with the world represents a remarkable number on the international economic map, but the inter -part of them is still limited compared to the potential, in light of continuous challenges facing Arab economic integration.

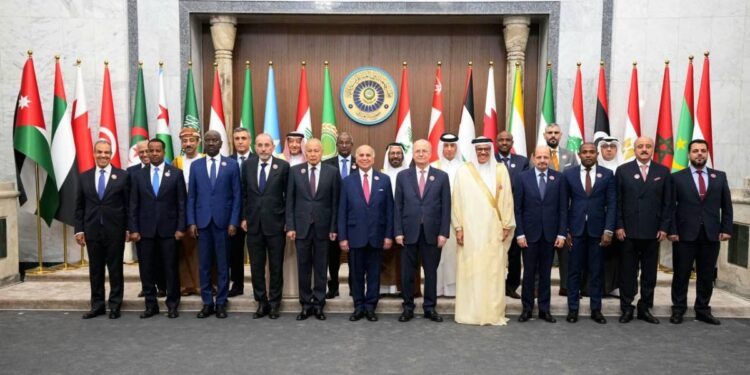

The Arab summit in Baghdad is held at a very important moment, and the member states provide a strategic opportunity to assess the reality of trade and inter -external trade and investment, define the obstacles that prevent their enhancement, and to propose practical mechanisms to expand their scope in a way that serves the interests of Arab peoples and enhances sustainable development.

The size and trends of Arab trade

Financial and economic expert Kazem Jaber notes that upward growth in the volume of inter -Arab trade of goods and services until the first quarter of 2025 is driven by relative trends of integration and economic growth.

Jaber told Al-Jazeera Net that preliminary estimates indicate that the value of the intra-commission has exceeded 550 billion US dollars in 2024, representing about 18-20% of the total Arab commodity trade, explaining that this growth is due to free trade agreements and efforts to facilitate trade exchange. But he stressed at the same time that these numbers are still without the real available aspirations.

Jaber added that the focus is still on the initial products and raw materials, which requires diversification and expansion of the trade base to include value -added products. Geographically, the spokesman pointed out that trade is concentrated between specific countries, calling for a more balanced distribution that includes various Arab countries.

Regarding inter -investment, Jaber explained that its growth is continuous, but it does not rise to the desired level. Its cumulative value has been estimated at 450 to $ 500 billion until the end of 2024, and these investments are concentrated in sectors such as real estate, tourism, financial services and infrastructure.

Jaber stressed the importance of directing a larger part of these investments towards the productive and technological sectors that directly contribute to achieving sustainable economic development. He stated that both Jordan, Egypt, Morocco and Algeria represent major destinations for these investments, while the Gulf states are the most prominent source of them, pointing to the increasing role that sovereign funds play in supporting this trend.

As for foreign trade, Jaber stressed that the Arab countries are a pivotal player in world trade with a total trade exceeding 3.5 trillion US dollars in 2024. Although exports are still dominated by oil and gas goods, this keeps the region’s economies vulnerable to energy price fluctuations.

He pointed out that Arab imports vary between manufactured goods and food and technological products, indicating that the European Union, China, the United States and India are among the most prominent commercial partners, with a noticeable growth of relations with Asian countries.

He explained that the Arab trade balance still depends largely on oil prices, noting that the trade surplus witnessed a decline in 2024, which reflects the urgent need for diversification of exports and enhancing productivity in other sectors.

He added that the Arab countries, especially the Gulf ones, possess huge investment assets abroad that are managed through sovereign wealth funds, distributed on various types of assets in order to achieve sustainable returns and diversify the sources of income. However, these assets face the challenges of market volatility and geopolitical risks, in exchange for promising opportunities in the global growth sectors.

The role of the summit in promoting trade and investments

For his part, the economist Ahmed Al -Ansari considered that the Arab Summit held in Baghdad represents a pivotal opportunity to draw a new path for Arab economic cooperation and enhance both trade exchange and inter -investments.

Al -Ansari told Al -Jazeera Net that the summit is able to pass clear strategies to accelerate Arab economic integration, by activating the major free trade zone and removing non -customs obstacles, calling for the launch of practical initiatives to encourage joint Arab investments.

In this context, he suggested the establishment of an Arab fund to finance regional projects, facilitate the procedures for registration of companies, and provide tax stimuli to Arab investors, considering that these steps are able to enhance the business environment and attract capital.

He stressed that the development of joint regional infrastructure in the transportation, energy and communications sectors is one of the pillars of trade and investment support, stressing the importance of activating the role of the Arab private sector through the establishment of cooperation platforms and organization of joint economic forums.

Al -Ansari pointed out the possibility of coordinating economic policies between Arab countries in the fields of investment, trade and taxes, in order to enhance the attractive environment for trade and strengthen economic ties.

He also called for the importance of enhancing Arab economic cooperation with international partners on the basis of serving common interests and supports sustainable development goals. He called for agreement on clear mechanisms to follow up the implementation of the summit decisions and evaluate the progress made periodically.

Al -Ansari concluded his speech by emphasizing the necessity:

- Accelerate the pace of Arab economic integration.

- Activating existing commercial agreements.

- Removing non -customs barriers.

- Attracting investments in the value -added sectors.

- Enabling the private sector and enhancing its role.

- Enhancing international economic cooperation.

- Organizing effective mechanisms to implement decisions and monitor their actual impact.