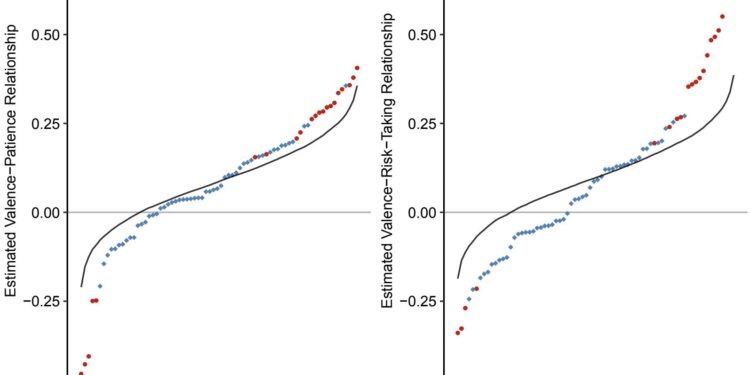

Cross-country variation in the relationship between positive mood and patience (a) or positive mood and risk-taking (b). Credit: Nature Human Behavior2024. DOI:

When making economic decisions, individuals can be influenced by a variety of factors, including their goals and emotions. Previous studies have hypothesized that emotions play a crucial role in economic decisions, especially those that involve risks or trade-offs between immediate and future benefits.

Researchers from the Stanford Graduate School of Business, Stanford University, and the University of Chicago Booth School of Business recently set out to study the relationship between emotions and economic choices in more depth by analyzing a large multinational data set.

Their conclusions, published in Nature Human Behaviorrevealed distinct patterns in the extent to which emotions predict economic decisions in several countries around the world.

“In 2019, we discovered a new dataset that measured how people made financial decisions around the world,” study co-author Samuel Pertl told Phys.org. “We were fascinated by this dataset, and as we dug deeper, we discovered an additional layer of information that the original research team hadn’t explored: the emotional experiences of the participants.”

“This aspect intrigued us because most previous research on the influence of emotions on decision making has been conducted in a few highly developed countries, primarily the United States. With nationally representative samples from 74 countries, we saw an opportunity to test whether the relationship between emotions and economic decision making replicates and generalizes globally.”

Some theorists have already suggested that the link between emotions and economic choices may be universal, with similar patterns across countries. The main goal of Pertl and colleagues’ recent study was to test this hypothesis by analyzing data from the Gallup World Poll and the Global Preferences Survey, two large-scale surveys covering a total of 74 countries.

“To examine how emotions influence economic decision-making, we used two different approaches,” Pertl explains. “There are already many studies on how incidental emotions influence individuals’ intertemporal or risky decisions. First, we summarized these studies using a meta-analysis, which pools existing results and summarizes them into an average relationship.”

The researchers’ meta-analysis found that most past studies were conducted on non-representative samples, usually from a few Western countries.

Predictors of country differences in the relationship between positive mood and patience (a and b) or positive mood and risk taking (c and d). Credit: Nature Human Behavior2024. DOI:

This encouraged them to conduct a global analysis, drawing on large multinational datasets. Collectively, Pertl and his colleagues analyzed survey responses from 77,242 people residing in 74 countries.

“Each respondent was asked about their emotional experiences, specifically whether they had felt happiness, pleasure, sadness, worry, anger, stress or pain during most of the previous day, with each emotion measured separately,” Pertl said.

“The dataset also captured how individuals made economic decisions, such as choosing between a smaller immediate reward and a larger future reward (intertemporal decision), or between a smaller certain reward and a larger, uncertain reward (risky decision).”

Using statistical methods, the researchers investigated whether emotions predicted respondents’ economic decisions, taking into account a variety of factors, including demographics, language differences, and geographic location. To determine whether the link between emotions and economic decision-making was indeed universal, they compared trends across countries.

“I think the most notable finding of our study is that there is substantial and systematic variation across countries in how emotions predict economic decision-making,” Pertl said. “For example, it has been suggested that being in a positive mood leads to greater patience (i.e., individuals are more willing to wait for a delayed reward).”

“However, our analyses suggest that this relationship is far from universal. We found that while being in a good mood was associated with greater patience in 53 countries, it was linked to greater impatience in 21 countries.”

Interestingly, Pertl and colleagues also found that cross-country differences in the relationship between emotions and economic decision-making can be explained. Specifically, they found that emotions were better predictors of economic decisions in more economically developed countries (as measured by the Human Development Index) and in more individualistic countries (as measured by Hofstede’s Individualism Index).

“Our results highlight the need for more diverse samples to study fundamental questions about decision making,” Pertl added. “While I am currently exploring questions in another research area, my co-authors are still working on several projects related to how emotions influence decision making.”

More information:

Samuel M. Pertl et al, A Multinational Analysis of the Relationship Between Emotions and Economic Decisions About Time or Risk, Nature Human Behavior (2024). DOI: 10.1038/s41562-024-01927-3

© 2024 Science X Network

Quote:Relationship between emotions and economic decision-making differs across countries, multinational analysis finds (2024, September 19) retrieved September 19, 2024 from

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no part may be reproduced without written permission. The content is provided for informational purposes only.