4/4/2025–|Last update: 4/4/202508:04 PM (Mecca time)

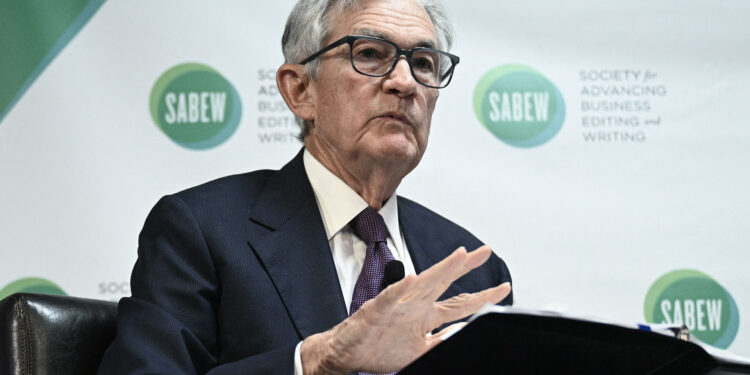

Jerome Powell, the President of the Federal Reserve (US Central Bank), has expressed great concern about the economic repercussions of the customs escalation launched by the administration of US President Donald Trump. For his part, US President Powell called on “to stop political manipulation” and work to reduce interest rates.

At a press conference held today, Friday, Powell described the new drawings as “greater than expected”, warning that it may increase inflationary pressures and slow the pace of economic growth.

Powell stressed that the federal reserve is committed to monitoring the situation closely to maintain economic stability, noting that the central bank “will not hesitate to intervene if necessary.”

Trump calls for an immediate reduction in interest rates

Before the Powell journalist conference, Trump had called on the Federal Reserve to reduce interest rates, describing the current moment as the “perfect time” for such a measure. “Lower interest rates, Jerome, and stop practicing politics! … I have always been late, but you still have an opportunity to change your image!”

Reuters said that Trump’s comments have increased tension between the White House and the Federal Reserve on the future trend of monetary policy, especially in light of the escalating economic turmoil.

Markets are returned with sharp fluctuations

Financial markets interacted with these conflicting statements with great fluctuations, as the main indicators of Wall Street witnessed sharp declines.

The banking sector was subjected to noticeable pressure, as shares of major institutions such as GB Morgan Chase and Goldman Sachs recorded heavy losses, amid fears that customs duties and global reactions will lead to curbing growth and reducing consumer spending.

Warnings of global recession

Senior economic analysts raised strong warnings of the entry of the American and global economy in a stagnation. GB Morgan indicated that the possibility of a global recession increased to 60%, after the previous estimate was 40%. She attributed this to the escalation of trade war, supply chains disorders, and a decrease in confidence in the business environment.

She explained that the new customs duties represent the largest tax increase in the United States since 1968, which increases the possibility of slowing investment and growth in the short term.

Wide international repercussions

The repercussions were not limited to the American economy, as China has already announced revenge fees, which could authorize a comprehensive trade war. European markets were also directly affected, as major indicators recorded sharp declines amid anxious concern about the global economy entering a slowdown.

While the US administration is calling for immediate cash measures, the Federal Reserve must balance inflationary pressures with the need to support economic growth. Investors and observers will continue to watch the next steps for the central bank in the coming weeks, amid a very complex economic scene.