The Israeli newspaper Globes, the economy, said that although Israel may succeed in reaching a new agreement with the United States that reduces the customs duties imposed on it, it will not be immune to the global consequences of the Trump’s commercial war that caused sharp collapse in global markets.

Wall Street has recorded the worst performance since the Korona pandemic

The last Thursday and Friday witnessed one of the worst trading sessions in the history of the Wall Street Stock Exchange. For the first time since March 2020, during the panic caused by the Kofid-19, the Standard & Poor’s 500 index lost more than 5% in two days, in the fifth worst performance in its history.

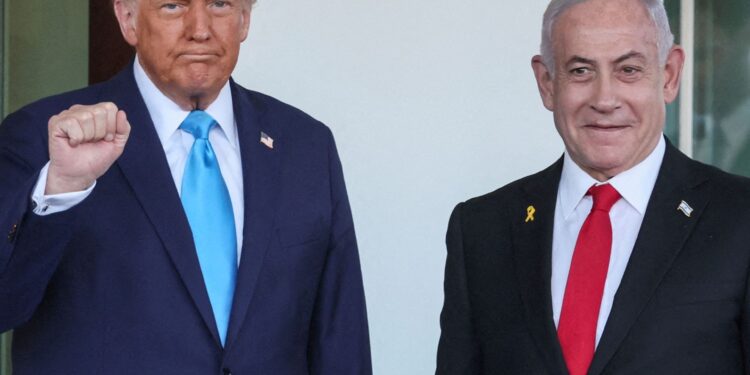

This collapse is a direct response to US President Donald Trump’s decisions to impose customs duties ranging from 10% and 54%, according to nearly all global trade partners, including Israel.

The Israeli economy has internal and external challenges

Although the Israeli Stock Exchange was not collapsed at the level of its American and European counterparts, the Tel Aviv index lost 35 approximately 4% on Sunday and 0.62% in the Thursday session. However, senior economists believe that this “relative calm” will not last if the American economy enters into an actual stagnation.

“Even if Israel has reached an agreement with the United States that reduces the fees, the growth of the local economy will slow down with the intensification of the global trade war,” said Moody Shafer, the chief strategy of markets at Hapoalim Bank.

“The good news of Israel is that the main economy engine is the exports of technological services, and it will likely be exempt from the fees,” said Jonathan Katz, chief economist at Lider Capital Markets, adding that “the slowdown in the global economy and low commodity prices will contribute to reducing import prices and thus reducing inflation.”

But Katz warned of the “impact of negative wealth” that will be generated by the losses of markets, as consumers’ feeling of confidence and richness will decline, and this will lead to a reduction in spending.

Discounts in growth expectations

For his part, Alex Zabingski, chief economist at the “Mitif” Foundation, said that this negative impact on consumer confidence will be reflected directly on the local demand during the next year, adding that he reduced his expectations for the growth of the GDP of Israel from 4% to 3.5%.

He pointed out that “the Israeli economy will be affected by many indirect ways, including the weakness of the labor market, the decline in the value of the audience’s savings, and a deterioration in public morale,” stressing that “the decline in global trade will negatively affect Israeli companies, especially those working in the technology sector, which has always been linked to the performance of the Nasdak index.”

Despite the hope of avoiding the worst scenarios through new trade arrangements with Washington, the Globes report shows that the Israeli economy is not immune to the consequences of a global trade crisis, which is accelerating with the escalation of Trump, the decline in the markets, and a global recession that no one may survive.