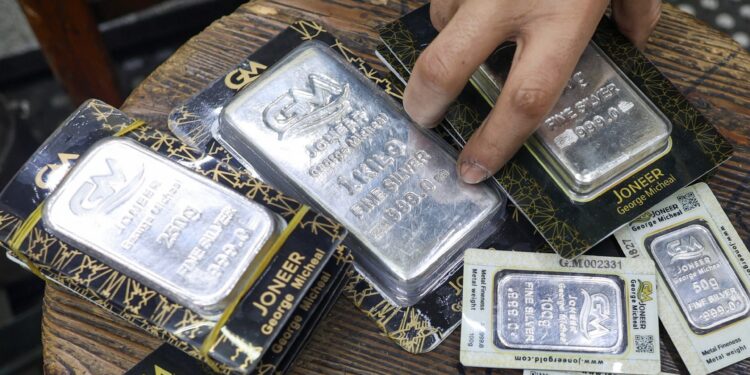

The price of an ounce of silver rose to $ 32.6 in the latest trading today, at $ 23, registered in May 2020.

Silver prices have witnessed a remarkable increase in recent months, driven by geopolitical tensions and customs duties imposed by US President Donald Trump over about 90 countries in the world, as well as global market turmoil.

As for gold, the price of its ounces in the latest transactions reached 3344 dollars, up from 2151 dollars in May 2020.

Here a question arises: What is the relationship between the two metal? Does the white metal compete with gold in the investment arena?

Historical relationship

The percentage of gold to silver is the number of silver ounces, which equals the price of one ounce of gold, which is the oldest follow -up to constantly followed, dates back to more than 3 thousand years BC.

Historically, this percentage played an important role in ensuring the value of the appropriate metal currencies, and is still an important technical measure for metal investors today, according to the “Vigioal Capitlist” platform.

The oldest registered example of this ratio dates back to 3200 BC, when “Mina” – the first kings of ancient Egypt – determined the 2.5: 1 ratio (that is, one ounce of gold is equal to 2.5 ounces of silver). Since then, this percentage has witnessed an increase in the value of gold in general, with the increased awareness of empires and governments in the scarcity of the two minerals and the difficulty of their production.

The old Rome was one of the first civilizations that set the percentage of gold to silver, starting from 8: 1 in the year 210 BC, and over the years gold and varying silver flows as a result of the invasions of Rome to the fluctuation of the ratio between 8 and 12 ounces of silver per ounce of gold, according to the previous source.

In the modern era, the percentage reached its peak in 1939 at 98: 1 after US President Franklin Roosevelt changed the legal price of gold from $ 20.67 per ounce to $ 35.

In 2020, the percentage reached its highest level at 125.1 during the Kofid-19 pandemic, as investors sought gold as a safe haven.

Silver in the fifth industrial revolution

Silver is a very important industrial stomach thanks to its unique characteristics, as it is the best known electrical conductor, which makes it an essential element in many technological applications. Although the demand for it was limited in the first industrial revolution, its role was clearly escalating from the second revolution with the prosperity of photography and modern industries, according to the “Monics” platform.

In the third industrial revolution, the boom in electronics and automation led to a significant increase in the demand for silver as an indispensable component in the electrical circuits, then silver in the fourth revolution became a pivotal in renewable energy technologies, especially in the manufacture of solar panels.

Today, in the fifth industrial revolution, and with progress in artificial intelligence, electric vehicles and self -driving systems, the importance of silver is more than ever, due to its vital role in delivering electricity and making accurate electronic components, which enhances its position as an indispensable metal in the future of the industry, according to the previous source.

Green Revolution .. Silver Revolution

The demand for silver is radically changed, which is a structural change in its nature, and this change will continue for years and perhaps for decades, and this inherent demand is likely to constitute an increasing pressure on the supply, and will affect silver prices significantly.

Half silver is currently used in heavy industries and advanced technology, including smartphones, tablets, auto electrical systems, solar panel cells and many other products and applications, according to global silver survey.

The largest artificial use of silver comes in two main sectors, according to the “Gold Silver” platform:

- PV sector (solar energy).

- Electric and hybrid car industry.

Research indicates that the demand from both sectors is very about to grow, due to the wide pursuit of more green technologies into society, as well as the use of silver metal in green technologies more than traditional technologies.

- Solar energy and increased demand for silver

The use of solar energy is an accelerated growth that exceeds what many imagined, as advanced economies and many emerging countries realized the great benefits of solar energy as a sustainable and clean source of energy.

Among the most prominent factors that drive this growth is the noticeable decrease in the costs of installation, which made solar energy a feasible option in economic and environmental aspects, and this escalating trend enhances the interest of governments and consumers alike, and confirms that the demand for solar energy will continue to rise, which means, of course, increasing the demand for silver as an essential component in the solar panels industry.

- Electric and hybrid car industry

- Electric cars consume approximately “twice the amount of silver” compared to traditional fuel cars.

- Silver hybrid cars consume 22% more than internal combustion cars.

- With major international companies to expand electric cars production, the industrial demand for silver is expected to rise sharply.

- Silver is also used in the manufacture of developed lithium batteries, which increases the demand for silver, according to the previous source.

Silver and gold … an investment comparison

According to Morgan Stanley, the following factors should be taken into account before making the decision to invest in silver or gold:

1- Silver is more related to the global economy and market fluctuations

Silver is closely related to advanced industries and technology, as a result, silver is more affected by economic changes in gold, which is limited to jewelry and investment.

With the prosperity of economies and trade movement, the demand for silver tends to grow.

2- Silver is more volatile than gold

Silver prices fluctuate two or 3 times larger than the fluctuation of gold prices, and although traders may benefit from this, it may pose a challenge when managing the risk of the portfolio of investors.

3- Gold is more effective to diversify the investment portfolio

Silver is a good option to diversify the investment portfolios, yet gold remains a more effective diversification tool, as it maintains a very low association with stocks and the rest of the main asset categories.

This is attributed to the fact that gold, unlike silver and other industrial minerals, is less affected by economic fluctuations, due to its limited industrial uses and its greatest dependence as a safe haven.

4- Silver is cheaper than gold

Silver is cheaper than gold. The price of an ounce of gold is currently more than 3 thousand dollars, while the price of an ounce of silver is about 30 dollars, which makes it accessible to small investors who want to own precious metals as material assets at the time of risk.

Gold or silver .. comparing long -term returns?

When looking at the historical performance of gold and silver since 1925, it turns out that the long -term returns of both were not impressive, especially after the calculation of inflation.

- Gold rose from $ 20.63 an ounce in 1925 to 2062.60 dollars at the end of 2023, achieving an annual return of 4.81%, according to the “Pancret” platform.

- As for the ounce of silver, it increased from $ 0.68 to 24.30 dollars during the same period, with an annual complex return of 3.71%.

With inflation (at a rate of 2.96%) in mind, the real growth in purchasing power was limited, especially in the case of silver. However, gold remains superior in historical performance, making it a more stable option in the long run compared to silver.

It is likely that gold will continue its superiority on silver, supported by structural transformations in the patterns of demand, according to a recent report issued by the “Goldman Sachs” group. The bank analysts indicated that the increase in the purchases of central banks of gold, especially after the freezing of Russian reserves in 2022, contributed to the pricing association between gold and silver, which lasted for decades.

Gold has a firm position as a cash reserve, which makes it more attractive to central banks compared to silver, which is more affected by the factors of industrial demand.

The report pointed out that gold is 10 times more rare than silver, and the highest value is 100 times for each ounce, as well as being chemical idle, which makes it ideal for storage and transportation.

On the other hand, silver is described as more volatile and less liquid, which reduces its usefulness as a backup asset. Although the mutation in the solar energy sector, especially in China, has reinforced the demand for silver at the beginning, the recent slowdown in production as a result of the excess of the supply reduced this support.

At the same time, central bank purchases are expected to continue to support gold prices during 2025, especially in light of the escalating concerns of possible economic stagnation in the United States.