The allies in the G7 countries agreed – today, Thursday – to lend Ukraine 50 billion euros, taken from the money generated by the frozen Russian assets. New aid is scheduled to begin arriving in Ukraine by the end of the year, and Kiev will use the money to strengthen its military defense against Russia, finance infrastructure reconstruction and finance the Ukrainian state budget.

The issue of using frozen Russian assets to help Ukraine is legally complex, and has moral and political dimensions as well. This decision faces major legal and diplomatic challenges, and may require special judicial or legislative decisions to confirm its legitimacy.

Proponents’ arguments

- Necessary punishment: The United States and other Western countries see the freeze on Russian assets as a necessary punishment for Russia’s war on Ukraine, and that using these funds to help Ukraine amounts to compensation for the damage done to it.

- Legal arguments: Some legal experts argue that sanctions allow frozen funds to be transferred for specific purposes, such as humanitarian assistance or reconstruction, as long as this is done in a transparent and accountable manner.

- Antecedents: Experts point to previous examples in which frozen funds from other countries were used to finance reconstruction efforts, such as in Yugoslavia and Iraq.

- Project compensation: Some specialists argue that the freeze on Russian assets was a punishment imposed on Russia for its war on Ukraine, and therefore using these funds to compensate Ukraine for the damages it suffered is legitimate. They point out that the frozen funds are owned by the Russian state, not private property, and therefore their use does not constitute confiscation of individual funds. Supporters of this decision assert that this step will help Ukraine rebuild its country and alleviate the suffering incurred by its people due to the war.

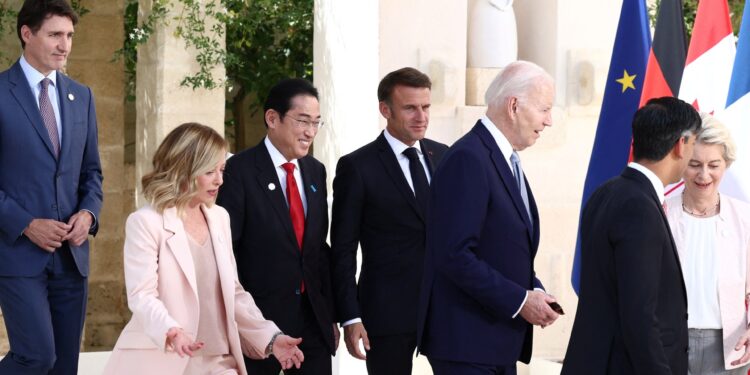

Supporters of the G7 decision believe that the use of Russia’s funds is legitimate and appropriate compensation for Ukraine (Reuters)

Opponents’ position

- Russian rejection: Russia strongly rejects this step, and considers it a theft of its money and a violation of international law.

- Legal concerns: Other experts argue that seizing assets without a judicial ruling sets a dangerous precedent that could undermine private property rights and open the door to abuse. Experts also point out the lack of clarity in the legal basis for using the frozen funds without Russian approval, especially in the absence of a UN Security Council resolution.

- Impact on financial stability: Some countries warn that the use of frozen funds could destabilize global financial stability and undermine confidence in the international financial system.

- Dangerous precedent: Critics warn that the use of frozen Russian assets could set a dangerous precedent for property rights abuse, which could encourage future seizures of funds for political purposes.

- Security Council: Opponents point out that the frozen funds are subject to international laws, and that their use requires approval from the UN Security Council, which has not happened so far.

- Escalating tensions: Those who reject the decision of the major powers express their concern that this step may lead to escalation of tensions between Russia and Western countries.

Are there any legal precedents or previous examples of frozen assets being used to support another country?

Using frozen assets to support another country is a very uncommon practice, but it is not without historical precedent. There are some examples that can be considered, although each case has its own legal and political peculiarities:

Iraq after the Gulf War: After the First Gulf War (1990-1991), Iraqi assets were frozen in a number of countries. Later, some of these assets were used to contribute to the “Oil for Food” compensation program launched by the United Nations. This program allowed Iraq to sell oil in exchange for humanitarian aid, and some of the frozen assets were used for this purpose.

Libya after the overthrow of Gaddafi: After the fall of Muammar Gaddafi’s regime in 2011, Libyan assets were frozen in many countries. Some of these assets were later released to support the new Libyan government in reconstruction efforts and the provision of basic services.

Frozen Iranian assets: In some cases, Iranian assets frozen in the United States have been used for humanitarian purposes or to compensate victims of terrorist attacks. An example of this is a US court’s decision in 2016 to use some Iranian assets to compensate victims of the September 11 attacks, although this decision was the subject of significant legal controversy.

Afghanistan: After the fall of the Taliban government in 2001, Afghan assets abroad were frozen, and some of these assets were used to support the new Afghan government and for humanitarian purposes.

However, it should be noted that using frozen assets to support another country is often surrounded by significant legal and political complexities. Decisions to freeze assets and their use usually require strong legal support, such as resolutions from the United Nations Security Council or specific national legislation.

Are there any legal or political restrictions on using frozen assets to support Ukraine?

Legal restrictions

- 1- International law:

– Geneva Conventions: Provides for the protection of state property during armed conflicts, and the use of frozen assets may be interpreted as a breach of these agreements.

– United Nations resolutions: Some frozen assets may require specific Security Council resolutions to be released or used for certain purposes.

- 2- National laws:

– Local legislation: In many countries, the use of frozen assets requires judicial or legislative approval. Without these approvals, it is legally difficult to transfer assets to another country.

– Judicial restrictions: Affected entities (such as the Russian government or Russian companies) could file lawsuits challenging the use of the frozen assets, which could delay or prevent their use.

Political restrictions

- 1- Diplomatic relations:

– International tensions: Using frozen assets to support a state in dispute with the state whose assets have been frozen can increase diplomatic tensions and lead to an escalation of the conflict.

– Russian reactions: Russia may take retaliatory measures, such as freezing international assets or imposing new sanctions.

- 2- International public opinion:

Divergent positions: Countries that decide to use frozen assets may face opposition from other countries that do not agree with the measure, which could complicate international relations and alliances.

- 3- Legal and political precedents:

Legal precedent: Such steps may create new precedents in international law that may be controversial and open the door to the use of frozen assets in other disputes.

Economic considerations

- 1- Market stability:

Impact on financial markets: The release of large amounts of frozen assets may affect the stability of financial markets, both in the countries where the assets are frozen and internationally.

- 2- Impact on commercial relations:

Reciprocal Sanctions: The use of frozen assets may result in reciprocal economic sanctions affecting global trade.

Conclusion

While there may be strong Western motivations to support Ukraine through the use of frozen Russian assets, this decision is complex and requires careful legal and diplomatic consideration. The countries concerned must consider the legal, political and economic consequences before moving forward in this direction.

There is no easy answer to the question of the legality of using frozen Russian assets to help Ukraine. The issue requires careful legal analysis and a comprehensive study of the repercussions of such a step.