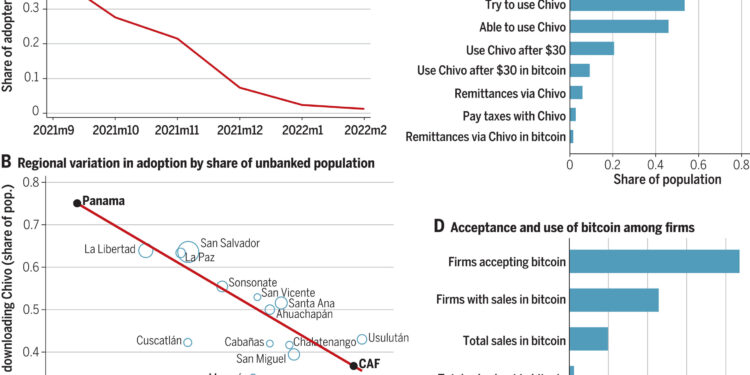

Adoption of Chivo Wallet in El Salvador. (A) Dynamics of Chivo Wallet downloads and (B) regional variations in adoption across regions of El Salvador by share of the unbanked. (C and D) Summary of survey results on individual and business adoption, respectively. Credit: Science (2023). DOI: 10.1126/science.add2844

A trio of economists and financial analysts, two from Yale University and one from the University of Chicago, conducted a case study of a national cryptocurrency experiment to better understand why such a monetary system might or might not work as expected. In their article published in the journal ScienceFernando Alvarez, David Argente and Diana Van Patten, describe their analyzes of an attempt by the government of El Salvador to make cryptocurrency a popular choice for that country’s population and what they discovered in doing so.

Over the past half century, it has become clear to some that established banks and the banking system in general do not always treat people at the bottom of the economic ladder favorably. For this reason, various alternatives have emerged.

One of these alternatives is cryptocurrency. It has been defended as a currency for the poor because of its anonymity: people who use it do not have to disclose their personal information or credit history. Unfortunately, this same positive attribute has led some to accuse cryptocurrency systems (such as Bitcoin) of allowing criminals and terrorist organizations to move money without being traced.

In this new study, researchers asked how average people perceive such systems and whether they are willing to adopt them. To this end, they conducted a case study on the history of Bitcoin in El Salvador.

In 2021, the government of El Salvador officially recognized Bitcoin as legal tender throughout the country, hoping to give it credibility. As part of this effort, it began allowing citizens to pay their taxes using the system. The government also ordered all businesses in the country to start accepting Bitcoin as a form of payment, including debt collectors.

Then, to make it easier for everyone in the country to use the new monetary system, they introduced Chivo Wallet, a phone app that could be used to exchange Bitcoin and US dollars. However, the government has not stopped the use of the US dollar as a legal means of exchange: the country’s official currency, the colón, is rarely used and has largely disappeared from circulation.

To learn more about acceptance or non-adoption of the new monetary system, researchers conducted face-to-face interviews with people living in 1,800 households across the country. They also had access to transaction numbers for Chivo Wallet.

The research team found that Bitcoin usage in El Salvador has remained low and its use has been declining since the government began its efforts. According to the team, the reason given for refusing to adopt the new monetary system was mainly transparency and privacy concerns: ordinary people do not trust the people who manage the cryptocurrency system. For this reason, most still preferred cash, American cash. They also found that most Bitcoin users in El Salvador are wealthy people who also continue to use the traditional banking system.

More information:

Fernando Alvarez et al, Are cryptocurrencies currencies? Bitcoin as legal tender in El Salvador, Science (2023). DOI: 10.1126/science.add2844

© 2023 Science X Network

Quote: Cryptocurrency case study suggests many don’t trust its transparency and privacy (December 22, 2023) retrieved December 22, 2023 from

This document is subject to copyright. Apart from fair use for private study or research purposes, no part may be reproduced without written permission. The content is provided for information only.