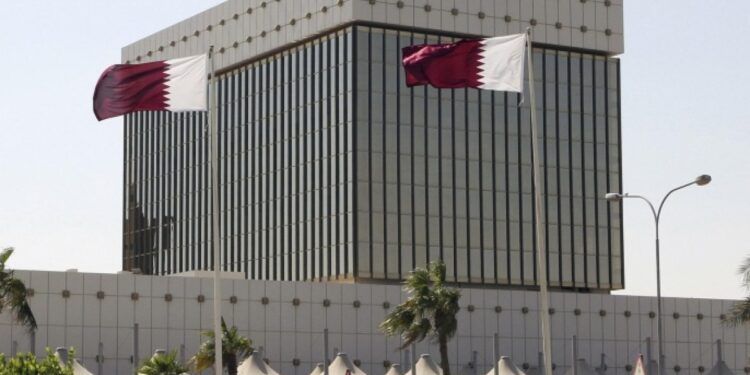

The Qatar Central Bank announced the launch of the digital currency project after completing the development of the project’s infrastructure, which will serve as a proactive step to keep pace with the rapid global developments in this field, according to the bank’s official statement.

The Central Bank also confirmed that it will experiment and develop selected applications for its new digital currency, to settle high-value payments with a group of local and international banks in an experimental environment designed according to the latest advanced technologies.

As of last May, there are 3 countries operating digital currencies for central banks, which are the Bahamas, Jamaica, and Nigeria, and there are 36 pilot programs for these digital currencies under implementation, and 19 of the G20 countries have programs for this currency in the development stage, according to data from the Atlantic Council Foundation. .

So what are these new digital currencies? What is its purpose?

Central bank digital currency

Money as we know it is a currency issued by governments and can be considered a legal contract that can be exchanged for the goods and services we desire.

Money has traditionally been represented by banknotes and coins, but technology has made it possible for governments and financial institutions to supplement physical paper money with a credit-based currency model that records balances and transactions entirely digitally.

Cryptocurrencies such as Bitcoin and the technology that relies on it – which is “Blockchain” technology – have stimulated more interest in these digital transactions, and there are societies and countries that have begun to limit the use of paper currencies and moved to completely digital transactions, but this does not mean that their currency itself has become digital, as the dealing between… People happen digitally, but the currency itself has a presence in the bank account.

For example, if you are buying a product from a seller and decide to pay him using one of the money transfer applications, you will pay the price of the product directly to his bank account. The transaction between you here is digital, but the price of the product was transferred by the bank from your account to the seller’s bank account in paper currencies.

Central Bank Digital Currency (CBDC) is a type of digital currency issued by central banks in countries, and we can liken it to encrypted digital currencies except that its value is fixed, unlike encrypted currencies, and the central bank determines that value because it is simply equivalent in value to the country’s paper currency.

The digital currency of the central bank is similar to cryptocurrencies in that it is software codes that operate with “Blockchain” technology, that is, it does not have a financial equivalent of paper money in bank accounts, but the other difference is that it is a central currency, meaning that the bank controls it and determines its value, unlike cryptocurrencies that are primarily based On the idea of decentralization, according to the “Investopedia” website.

What is its purpose?

The primary purpose of central bank digital currencies is to provide privacy, convertibility, convenience, ease of transacting, and financial security to businesses and consumers when conducting financial transactions.

This type of digital currency can also reduce the cost of maintenance required by the complex financial system, and save the usual costs of minting paper currencies, in addition to reducing the costs of financial transactions outside the country, because the fees for transferring money abroad will be very low, and foreign transactions will speed up, and can occur. Transfers within seconds, according to the World Economic Forum website.

It will also facilitate the tracking of funds, and thus reduce the rates of money laundering operations and their transfer to carry out various crimes.

As for the digital currency of the Qatar Central Bank, the project will focus on applications aimed at increasing access to capital markets for banks operating in the country, while enhancing local settlement and improving the efficiency of securities transactions.

The Qatar News Agency also stated that this project reflects the Qatar Central Bank’s full commitment to contributing to achieving digital transformation within the financial sector, especially since starting the digital currency project constitutes an important milestone and a strategic step towards building a digital economy in the country.

It is noteworthy that the results of this experiment will be the cornerstone towards identifying the different use cases that the Qatar Central Bank will adopt in the future.